Are you stressed about the economy?

Most people have felt the crunch of the Federal Reserve raising interest rates to their highest point in decades. We begin to feel the stress on our wallets as these rate hikes trickle through our economy. The news headlines paint a rough picture with unemployment increasing and layoffs around the country.

Where do we go from here?

The best hypotheses on where the economy will go are just that – hypotheses. No one can predict with absolute certainty which banks will collapse or where interest rates will go. We can only focus on ourselves and our family’s well-being.

What do we have control over?

Since the economy is outside of our control, what are things we can influence to ease financial stress? We live with a lot of things/items that we could go without for a short period of time or cut out altogether. This can be difficult as it is a sacrifice. Below are a few ways to adjust spending to help ease financial stressors.

- Focus on absolute needs versus wants

- Limit miscellaneous spending

- Only necessary groceries

- Convenience items – yes, Starbucks can be limited

- Limit impulse spending

- Create lists of items needed to purchase to stick to

This way the money that is saved can be put toward debts or other credit cards that are causing more stress in your life.

Extra income..?

Maybe you want to prep for the economic downturn and try and start a side hustle to pay off debt even faster or build an emergency fund. Without spreading yourself too thin and managing to obtain adequate amounts of sleep and healthy eating habits – this could be a viable option.

Ways to manage stress when it comes to finances.

- Clear communication about expectations you have about money with your family

- Communicate about needed changes in spending habits

- Automate savings or debt payments to remove temptation to use money in other places

- Create a budget with your partner or family

- Use mindfulness skills to manage your mood when talking about money

- Explore your attachment to money and where you learned how to use it

- Increase awareness of how you view money and its role in your life

- Increase knowledge about how money works via blogs, blooks, and YouTube

Money plays an important role in our society. Learning about your relationship with money can help you make informed decisions down the road. Increasing communication and mindfulness skills may help you approach money topics in an effective and goal-oriented way.

Stress permeates our life.

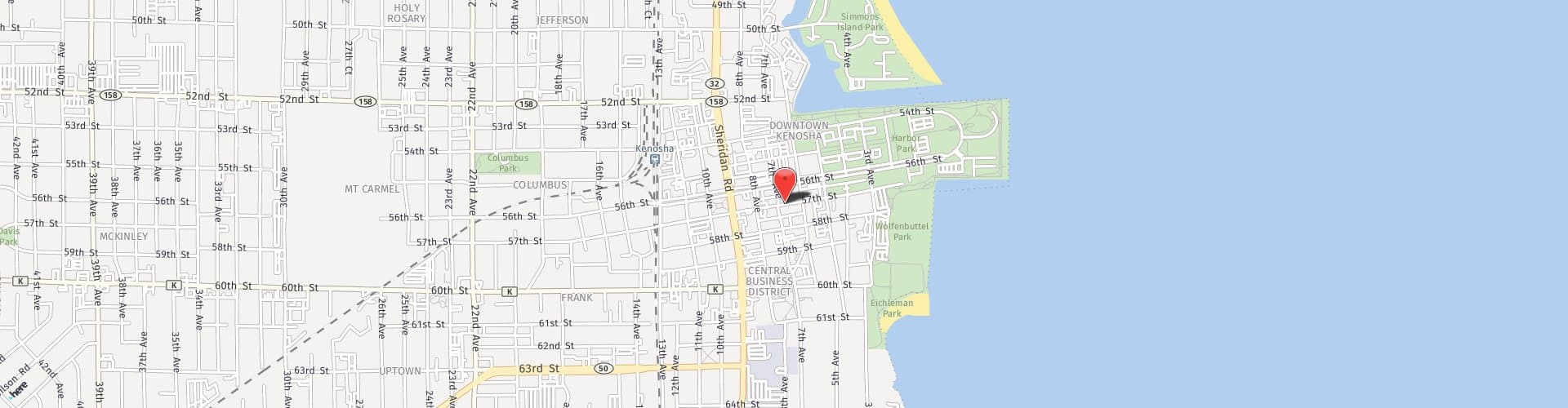

If you or someone you know experiences financial stress on a regular basis it can become toxic. Talking to a therapist near you can help alleviate or approach stress in a healthier way. Call now or click here to schedule a 20-minute consultation call with to learn how therapy can help you.